PLSA retirement living standards: how should pension schemes respond?

It’s positive that the cost of living in retirement is no longer soaring, but the figures remain daunting – especially for people who live alone and women.

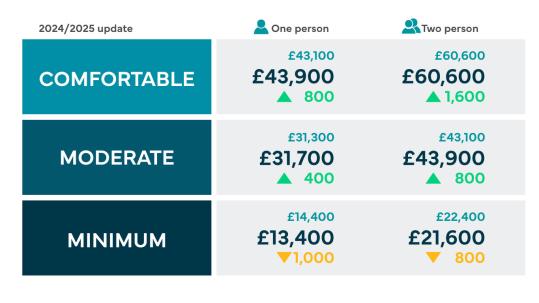

Each year, the Pensions and Lifetime Savings Association (PLSA) publishes estimates for the income someone will need in retirement. It has three retirement living standards – minimum, moderate and comfortable – and the latest figures are out today.

Lots of elements make up the standards and they change from year to year, but holidays are a good way to compare them.

If you’re getting by on the minimum standard, you should be able to afford a week away in the UK each year. Moderate allows you a fortnight at a 3-star all-inclusive hotel in the Mediterranean and a UK weekend away. And if you’re comfortable you should get away for a 4-star Med fortnight with spending money plus a few weekend breaks.

With the return of high inflation, the amount of money needed for each category has risen rapidly – by 38% on average across the standards over the past three years.

The cost of retirement remains high

The good news is that the period of double-digit annual increases is now over as inflation has slowed. In fact, the minimum standard for someone living alone outside London has fallen by £1,000 to £13,400 a year as energy costs have dropped.

The equivalent cost has increased by £400 to £31,700 for a moderate retirement and £800 to £43,900 in the comfortable category – relatively minor increases. You can compare this year's standards with last year's here:

But these are big annual sums of money, especially when we consider the savings needed to achieve them. For example, the PLSA estimates that someone living alone receiving the full state pension would need a pot worth between £330,000 and £490,000 to buy an annuity for a moderate living standard.

These are scary numbers for many people. I find them alarming and I’ve worked in pensions for more than 30 years. While trying to encourage people to save more, we don’t want to make them so frightened that they give up and default to doing nothing.

Perhaps with this in mind, the PLSA has focused this year on ways people can share costs in retirement, even if they aren’t living with a partner. It has changed the terminology from “single” and “couple” to “one-person” and “two-person” to reflect these options.

Living alone makes retirement more expensive

It makes sense to consider the effect of living alone or with someone else in retirement. For a moderate living standard, one person will need £31,700 annual income but for two people the total is £43,900 – or £21,950 per person. Quite a difference.

The last census showed that 3.3 million people aged 65 and over lived alone in 2021 – 30.1% of that age group. By 2043, that number is predicted to rise to almost 4.5 million people as the population ages.

This trend raises questions for us a society. Pensioners living alone are much more likely to be in relative poverty, and more than a million older people say they go for a month without speaking to a friend, neighbour or family member.

Many of us will have little choice but to live alone at some point in retirement. Our charity partner, Re-engage, exists to reduce loneliness in old age and Re-engage provided some of the data in this article.

Women have smaller pensions than men

Someone living alone will rely on their pension savings, perhaps supplemented by their spouse’s pension if they are widowed. One of the main things affecting the size of your pension pot is your gender. And if you’re a woman, you are more likely to live alone in retirement.

Our data shows that, on average, women who have paid into a defined benefit pension plan receive only half the amount paid to a man. And when we looked at defined contribution (DC) savers, the picture was the same. The average DC fund pot for a female member was only half that of a man.

We would have expected a smaller gap for DC savers, and these figures showed that the gender pensions gap is a persistent problem. And in many cases the problem is worse because women disproportionately live alone in old age – 36% in 2021 compared with 23% for men.

People need our help to save more

There is a lot more we as an industry and society can do to help people save more for their future. And people do need help.

Auto-enrolment has got millions of people into the savings habit, but with more than 12 million people still not saving enough, the government may need to consider further options. We wrote about this here.

People fail to engage with their pensions on multiple levels – from checking contributions and likely retirement outcomes to even knowing if they have a workplace pension. Research shows 27% of people haven’t checked their pension in the past year – or at all.

Pensions dashboards should improve things by making pensions easy to access and, we hope, raising awareness through a big publicity campaign. But pension schemes and administrators should play a part too.

Let’s respond to the way people live today

Pensions lag other sectors and parts of financial services when it comes to digital services. About three-quarters of over-65s use a smartphone and that number will keep rising – so we need to adjust to the way people manage their lives today.

At Aptia we’ve launched our first app – My Pension @ Aptia – because we know many members want to engage with us on the move. And an app lets them check in easily, just as they do when checking their bank balance.

We’ll be adding features such as live chat and enhanced notifications to help members engage with their pensions. And we’ve got various ideas for the app to keep members interested and guide them to better outcomes.

Here are some other things our industry could do better:

- Make the most of digital platforms to tailor communications to different groups of people at particular times in their lives. Make it relevant and give people ideas they can act on instead of sending them standard information

- Use the data we hold as an industry to understand people’s needs and target them. If we know that female members aren’t saving enough and are more likely to live alone in old age, what are we doing to help women savers make the right choices?

- Help people understand where they are today so they can take steps to get where they want to be. The same applies whether you’re in your early 20s or your mid-50s. Pensions dashboards will be a step forward and there is other good work going on

The PLSA’s standards are a valuable benchmark, but only if they encourage people to take control of their pensions. And experience tells us they need all the help we can give them to make that move.

The content provided in our publications, including articles on our website and podcasts, is intended solely for informational purposes. It should not be construed as professional advice and should not be relied upon for any purpose. We strongly recommend seeking appropriate professional advice tailored to your specific circumstances before making any decisions based on this information.